Use your UCAS status codes to open a student account

Save yourself time and effort by using your UCAS status codes when opening a bank account. These codes allow a number of banks to confirm your eligibility for their student accounts.

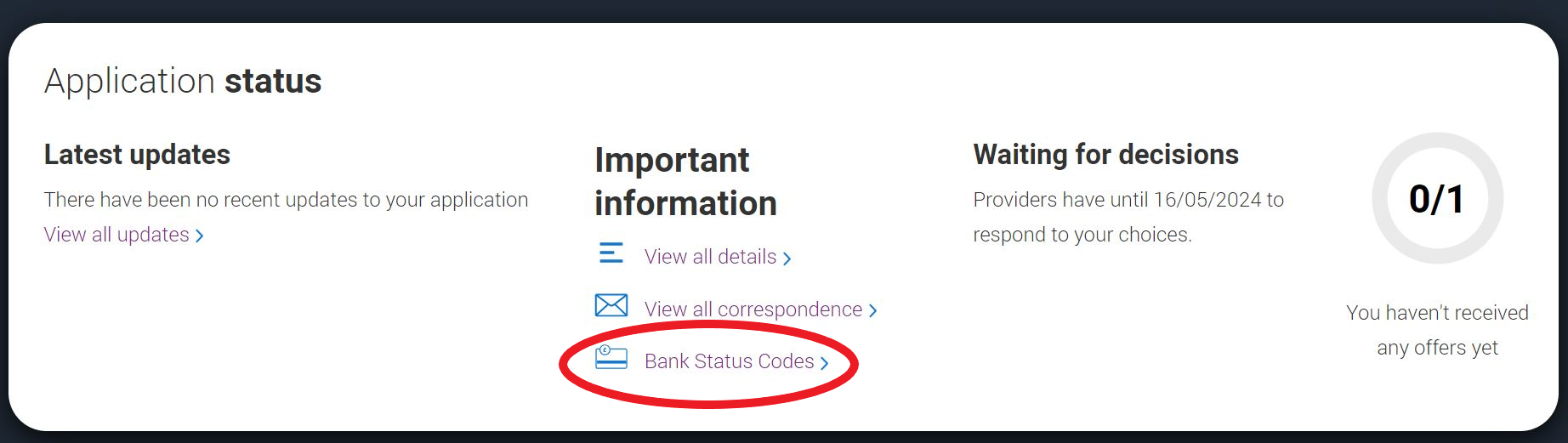

Once we receive your application, we create your personal status codes and you will find these in your application in your UCAS Hub.

Once your place at uni or college is confirmed, it's really important to remember to take your codes with you when you go to open a student account. This will speed up the whole process, by allowing the bank or building society to quickly confirm your status as a future student.

Why do I need a student account?

Student accounts offer extra features especially for students. It’s not compulsory to have a student account if you’re going to uni, but if you’d like to open one, the two UCAS status codes we’ve sent you may make it quicker.

- If you don’t already have an account with the bank or building society you want to open a student account with, you’ll need to set up a new one.

- If you do already have an account with that bank or building society, they may be able to upgrade it to a student account.

For more information, contact the bank or building society – you’ll find contact details on their websites.

When should I set up a student account?

- You’ll probably want this in place for when you start your course, so you have access to all the exclusive features as soon as you begin your studies.

- Depending on the bank or building society, you may be able to access an account once you’ve accepted a conditional offer, or you may need to wait until your place is confirmed.

- In either case, your UCAS status codes will help the bank or building society determine your eligibility for their student accounts.

I’m not from the UK, how do I open a student account?

If you’re coming to study in the UK from another country, contact the bank or building society you wish to open a student account with for information about how to apply.

For an overview of what is involved, this sponsored video covers the process.

It’s not compulsory to open a student account – it’s your choice. Not opening one will not affect your university place.

If you have any questions about this service, get in touch on social media.

Banks who use our digital ID service

Please note, this should not be taken as UCAS endorsing the organisation(s) included within this webpage.

- Nationwide

- Barclays

- Santander

- Natwest/RBS

- HSBC

- Lloyds Bank