How are students spending and budgeting in 2025?

Discover the UK’s most affordable university cities, plus the typical costs you’ll need to budget for as a student.

From choosing the right course to the perfect accommodation, you’ll have so many things to think about when heading to university. But budgeting and money management should also be near the top of your priority list.

The 2025 NatWest Student Living Index reveals the common bills and expenses you’re likely to face at uni, while showing how undergraduates are adapting.

Compare the benefits of different cities

Lincoln is now the most affordable city for students in the UK, according to NatWest, with Bolton and Cardiff just behind it. They’re followed by Birmingham, Liverpool and Chester.

To work it out, researchers divided average monthly accommodation, activity and item costs by students’ average monthly income.

Just remember that affordability is only one factor to consider when choosing a university town or city. You could also think about:

- the course content and reputation

- location factors

- accommodation options

- culture and atmosphere.

Be prepared for university costs

If you’ve never lived away from home before, the costs of student life might come as a surprise. So, it’s useful to be prepared.

According to NatWest, students typically spend the most on rent each month (£562.67). Milton Keynes (£490.64), Newcastle Upon Tyne (£492.27) and Sheffield (£493.14) are the cities with the cheapest average rents.

After their rent, groceries (£146.76), household bills (£124.08), and clothing, shoes and accessories (£123.30) are the next biggest spends each month.

Here are some other common costs you’re likely to face at uni:

- A night out typically costs £30.83, with students in Loughborough (£23.90) and Milton Keynes (£24.17) spending the least. You could trim these costs by looking out for student nights, special offers, or going out in the week.

- Average pint (+39%) and takeaway (+180%) prices have surged since 2015. So, it might be worth picking and choosing when you have them. A fifth of students say they never visit pubs or go drinking with friends.

NatWest Student Living Index

Download the full NatWest Student Living Index for deeper insights into the Class of 2025. Get the lowdown on typical student expenses and the most affordable university cities.

Get into a budgeting habit

Paying bills and expenses doesn’t have to be a chore. By getting into a budgeting habit early, it should be easier to keep on top of things.

NatWest found that 28% of students carefully track their monthly spending, while 33% have confidence in their money management skills. On the flipside, 53% run out of money before their term finishes, and financial strains have caused a third to think about dropping out.

Here are some ideas to get you started with budgeting:

- Consider different tactics. Half of students are now going on fewer nights out. And around a third (34%) have cut back on online shopping.

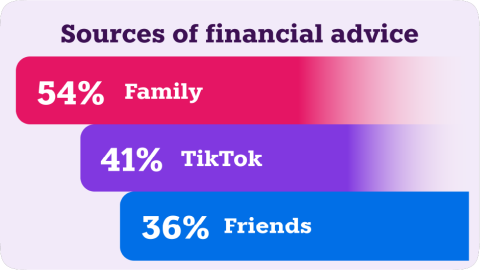

- Find the right sources of advice for you. Students turn to family for financial tips the most (54%). More than two fifths (41%) seek ideas from TikTok.

- Review your income streams. Family, savings and paid term-time work remain students’ main sources of financial support. But a growing number have used influencer marketing and side-hustles.

Stay wary of scams

In an increasingly digital world, it’s important to be vigilant around scams and fraud.

With those encountering threats jumping from 30% to 57% during the past year, and on average students losing £287.60 to fraud and scam activities, here are some things to watch out for:

- Banking scams have climbed from 9% to 25%, making them the biggest potential danger in 2025. Make sure any communications you’re receiving from your bank are properly addressed to you, and come from an official email address and phone number.

- Investment and tax rebate scams have affected 13% of students. If something sounds too good to be true, it probably is!

- Tax rebate scams claiming to be from HM Revenue and Customs have risen 8 percentage points. If you’re due a tax rebate, it will come via the post. You should never receive a text, email or social media message claiming you’re due a refund. And you should never be expected to share bank details with HMRC.

- Delivery service scams have fallen to 10% from 24%. But it’s important to stay vigilant. Again, you should never share bank details. Check contact details, whether phone numbers or email addresses, to ensure they seem legitimate.

Look after yourself

Money management can take a toll on anyone’s mental health. NatWest found that it’s fuelling high stress levels among 22% of students, with 59% preferring to avoid talking about their finances with peers.

But it’s important you don’t suffer in silence:

- Exercise and sports (38%), meditation (25%), and self-help books (20%) are students’ top stress solutions. Think about the activities that might boost your mental wellbeing.

- A third of undergrads receive support from their university, with 31% offered counselling. So, it’s always worth checking what resources are available to help you.

- 4% of students have been tempted to overspend due to fears of missing out. While eating out and takeaways (40%), alcohol (32%), and items of clothing (22%) were named as their biggest spending errors. A quick look at your weekly spending could flag any areas for improvement.

Ready to learn more about student life in 2025?

From budgeting tactics to time spent studying, read the full NatWest Student Living Index for deeper insights into the Class of 2025. Get the lowdown on typical student expenses and the most affordable university cities.

Download NatWest's Student Living Index

The NatWest Student Living Index is based on a survey of 5,001 UK undergraduates conducted between 22nd April and 20th May 2025 by Savanta.